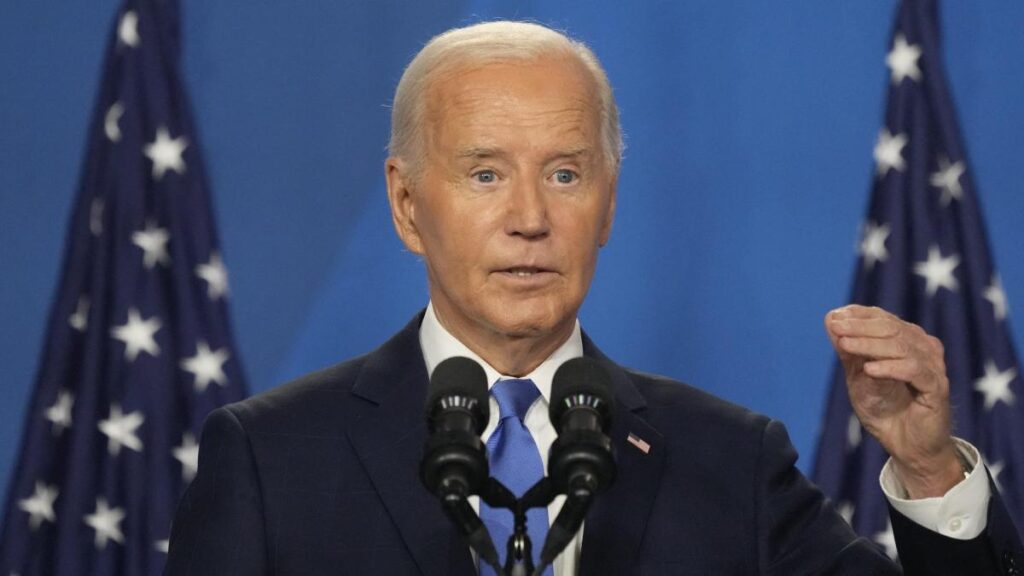

Pool / ABACA / Shutterstock.com

Increasing pressure from Democrats for President Joe Biden to withdraw from the presidential race has led to the inevitable conclusion: Biden withdrew from the election today.

Biden has endorsed Vice President Kamala Harris as his new nominee, but Democrats still have the power to propose another nominee.

How will this impact the economy, and especially the stock market? Let’s see what experts have to say about this.

If Trump wins, consider investing in these areas as well.

Check it out: How I went from middle class to upper middle class

Read more: 5 clever things wealthy people do with money

Wealthy people know the best financial secrets. Learn how to replicate them.

Immediate reaction: Increased volatility

Several experts argued that Biden’s departure from office would lead to increased market volatility.

“Investors generally like stability and predictability, and major political changes like this will disrupt both,” said Josh Thompson, CEO of Impact Health USA.

He said the initial reaction could be a sharp drop in stock prices as investors try to avoid potential risks.

Michael Collins, CFA, founder and CEO of WinCap Financial, echoed the sentiment, saying he feels a Biden withdrawal would all but guarantee a Trump victory and that a change in leadership could lead to increased uncertainty and volatility in the markets.

“Investor reactions may also vary depending on who the new Democratic frontrunner is and what policies he or she pursues on businesses and the economy,” he said.

“This could be a positive for U.S. stocks.”

Now, when it comes to specific sectors, some experts have argued that the withdrawal could be positive for U.S. stocks.

Timothy Holland, CFA, chief investment officer at Orion, said Harris, Biden’s “most likely successor,” could be seen as a weaker candidate against Trump. But he said that “it could help Wall Street rally U.S. stocks.” [begins] Consider the fiscal policy context and set prices [features] “This is due to both the extension of the Trump tax cuts and increased government spending, especially on the military.”

Holland also said that such a combination could stimulate the U.S. economy and corporate profits in the short to medium term, leading to higher stock prices.

“That said, faster economic growth could push up inflation over the longer term, forcing the Fed to reverse course from its (expected) 2024 rate cuts to a rate hike in 2025 or 2026,” he said.

Veda co-founder Stephanie Vaughn also said Biden’s withdrawal from the race would likely have a positive impact on the US stock market.

The story continues

“The selection of Kamala Harris would certainly create a situation in which Trump has a better chance of winning,” she said, “and Trump clearly supports growth and innovation, both of which the American economy desperately needs right now. So assets would almost certainly benefit.”

Gold and silver could benefit

Most of the reactions after that will be based on specific candidates, said Peter Earl, a senior economist at the American Institute for Economic Research.

He said there will be a lot of uncertainty until that person is nominated and accepts the nomination, which will tend to be favorable for gold and silver.

“Uncertainty about who the nominee will be willing to be, so investors will likely seek safe havens until they determine whether Biden’s successor will continue or reverse the Biden administration’s policies of high taxes (likely to increase taxes), increased regulation and government intervention,” Earl said.

He also said that until that is decided, a store of value will likely be sought.

Thompson echoed the sentiment, saying a sitting president dropping out of a reelection race would be an unprecedented event and could raise fear and caution among investors.

“This could create a more risk-averse market environment, with investors preferring safe and stable investments over riskier stocks,” he said.

Impact on bonds

While “it wasn’t a huge impact,” Holland said, bond yields rose and bond prices fell after the presidential debate as Wall Street banked on the possibility of a Republican landslide victory on Election Day, an extension of the Trump tax cuts and increased government spending, especially on the military.

“Developments that are likely to cause inflation (as we all know, weaker than expected labor market and inflation data immediately pushed yields lower and bond prices higher),” he said.

Conversely, if the most likely candidate to succeed Biden is viewed as a weaker candidate against President Trump, we could see a similar movement in bond yields and bond prices, Holland said.

Impact on cryptocurrencies

Vaughn said the crypto market could see an upswing following Biden’s withdrawal.

“Most notably, a President Trump would be much more productive for the entire cryptocurrency ecosystem,” she said.

Jordan Rosenfeld contributed to this article.

Editor’s note on election coverage: GOBankingRates is nonpartisan and strives to provide objective coverage of all aspects of the economy and balanced reporting on politically focused financial stories. More coverage on this topic can be found at GOBankingRates.com.

More from GOBankingRates

This article originally appeared on GOBankingRates.com: Biden Withdrawal: 5 Possible Impacts on the Stock Market