Fintheum

Intraday Liquidity Profile

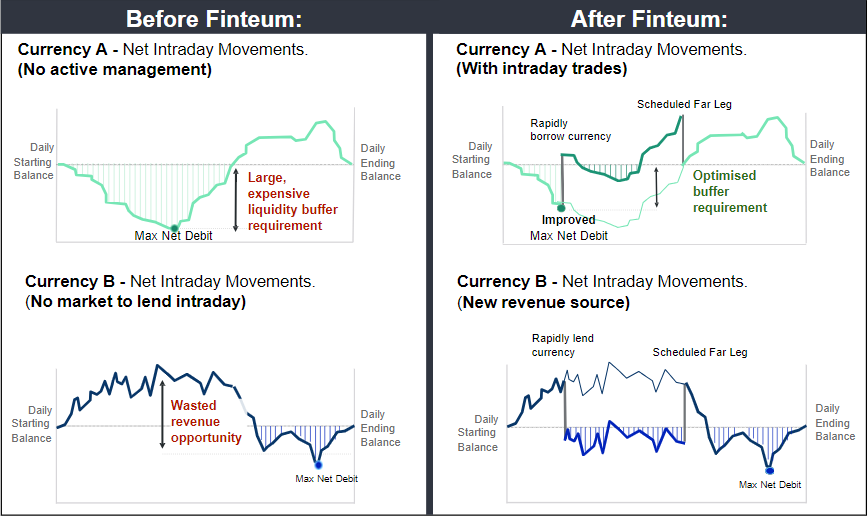

Finteum gives banks additional tools to control intraday patterns and access funds quickly when needed.

The new transaction type is expected to create an ultra-short-term interbank market, significantly reduce high quality liquid assets (HQLA) requirements for banks’ intraday liquidity, and improve dynamic access to funding.

The transaction was negotiated on the Finteum platform, which uses R3’s Corda, and executed on the TP ICAP UK MTF, with Finteum also acting as arranger.

Innovative trade flow solutions allow transactions arranged off-site to be executed and registered at the MTF.

LONDON, July 30, 2024 (GLOBE NEWSWIRE) — UBS and CIBC have cleared the world’s first intraday FX swap executed on a regulated exchange. Negotiated using the Finteum platform and executed on the TP ICAP UK MTF, the EUR/USD intraday FX swap was completed within minutes. Both legs of the swap were settled by the banks at pre-agreed times within the same business day at T+0.

With more banks preparing to execute similar transactions this year, the new approach is expected to bring significant savings for the big banks. With few solutions in place to control receipt of funds within settlement time, bank treasury teams maintain large buffers of high quality liquid assets (HQLA) for intraday use. Holding this HQLA has been particularly costly as interest rates have fallen more slowly than previously expected, and it’s estimated to cost big banks up to $75 million a year.

The distributed ledger technology (DLT)-enabled Finteum platform specializes in transactions that are completed in hours instead of days, avoiding unnecessarily lengthy transactions. This enables banks to fulfill customer obligations faster, reduce HQLA requirements, and meet growing regulatory expectations to fund payment activity in real time.

Rupert Hume Kendall, former chairman of Bank of America Merrill Lynch International and recently appointed vice chairman and director of Finteum, said: “The recent regulatory focus has highlighted the need for banks to have access to multiple tools and sources of liquidity. Intraday FX swaps and intraday repos are recognised as an increasingly important part of global banks’ liquidity management strategies and we are pleased to be working with many of the world’s largest banks to enable this new technology and reduce costs.”

Finteum has recently been registered with the FCA as an appointed agent, enabling the use of the Finteum platform to arrange interbank transactions. The innovative deal flow solution utilised by Finteum and TP ICAP allows transactions to be arranged off-venue and then subsequently executed and registered at the MTF.

The story continues

Adam Roberts, head of post-trade solutions EMEA at TP ICAP, said: “This groundbreaking achievement has enabled our partner banks to realise significant capital efficiencies and demonstrates our commitment to partnering with exciting new fintechs to drive innovation in financial markets. TP ICAP is committed to working with exciting start-ups like Finteum to deliver new and innovative trading solutions to our clients.”

A Finteum platform trial of USD intraday repo transactions involving 14 global banks in April conducted a simulated settlement and demonstrated the potential of the intraday repo market. Live repo transactions on the Finteum platform are expected in the second half of 2024.

The Finteum platform uses R3’s Corda, an open, permissioned decentralized platform for regulated markets. The DLT allows both parties to a transaction to send money or securities to each other without the need for the exchange or coordination of MT300 or similar confirmation messages. Post-trade actions such as “early expiry” or cancellation of a transaction are also agreed upon through the Finteum platform.

Kate Karimson, Chief Commercial Officer at R3, said: “R3’s Corda is designed for regulated markets, facilitating interoperability and integration. We are pleased to support new innovations in market structure with the introduction of Finteum’s intraday FX swap and intraday repo solutions, which will maximize efficiencies in this exciting new market.”

Banks using Finteum settle transactions using existing real-time gross settlement (RTGS) systems for intraday FX swaps. Finteum is built to integrate with any market infrastructure including RTGS systems, T2S and DLT-native technologies such as Fnality Payment System, HQLAX, Partior and OSTTRA’s PvP settlement orchestration solutions. Member banks intend to migrate FX swap settlement from RTGS systems to “Payment vs Payment” solutions where appropriate.

Anthony Clark Jones, head of the Strategic Ventures portfolio at UBS Investment Bank, added: “This world-first transaction via Finteum marks another step towards helping institutional investors and their partners realise the commercial, risk-related and client-related benefits of truly digital capital markets, complementing recent advances in other areas such as institutional digital cash and digital collateral.”

Finteum is building a second wave of banks that will go live on the platform and start benefiting from day markets in 2024. There will be an incentive structure in place for the second wave of banks. Contact Finteum or the TP ICAP team to set up a call or demo.

About Finteum

Finteum is a London-based startup building an interbank funding order and trade management platform. The Finteum platform is built for intraday funding, using FX swaps and repos as financial instruments.

Contact Finteum:

Brian Nolan

+44 (0)7849231644

Brian Nolan

About TP ICAP

TP ICAP Group plc is a financial services company headquartered in London, UK. The company’s shares are listed on the London Stock Exchange and are a component of the FTSE 250 index.

Contact TP ICAP:

Tom Gilbert, Communications Director

+44 (0) 203 933 0655

thomas.gilbert@tpicap.com

About R3

R3 is a leading provider of digital currency, digital asset and interoperability solutions. R3 supports central banks, corporations and FMIs by providing them with the tools to navigate the complexities of digitalization. R3 is committed to advancing financial markets. For more information, please visit www.r3.com.

Contact R3

Katie Jones

Eterna becomes R3’s partner

R3@eternapartners.com

References:

https://www.oliverwyman.com/content/dam/oliver-wyman/v2/publications/2018/june/Intraday%20Liquidity%20Final%20Report.pdf

https://www.oliverwyman.com/content/dam/oliver-wyman/v2/publications/2022/jun/Sept-Intraday-Liquidity-Report.pdf

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/fe9f8c35-e571-445f-9dc7-ae86846d8608