(Bloomberg) — Asian stocks rose on Monday, ending a three-day streak of losses amid a week of decisions from major central banks in Japan, the United States and Britain and earnings reports from big tech companies.

Most read articles on Bloomberg

Australian, Japanese and South Korean shares rose, while futures in Hong Kong were also slightly higher. The upbeat mood came after U.S. stocks surged on Friday on hopes that a looming interest rate cut will boost corporate earnings. U.S. stock futures rose on Monday.

The Bloomberg dollar gauge was steady, while Treasuries were little changed.

The focus this week will likely turn to policy decisions in Japan and the United States after speculation that the Bank of Japan might raise interest rates sent the yen soaring and sent global markets tumbling last week. Earnings from a host of companies, including Apple, Amazon.com Inc. and Microsoft Corp., will be analyzed after a disappointing start to the earnings season for major companies sent stocks plummeting.

“Big things are on the way this week,” Chris Weston, head of research at Pepperstone Group, wrote in a client note. For equity investors, the biggest risk is probably to earnings, as any big swings in reported earnings “could ripple through other stocks in the sector, increasing volatility across the index.”

The Fed is likely to signal plans for a September rate cut at the end of its meeting on Wednesday, economists said, which would mark the start of a series of quarterly rate cuts through 2025. Money markets are fully pricing in a September rate cut, with two more cuts possible by the end of the year, according to swaps data compiled by Bloomberg.

“While the July FOMC meeting may be too early to start cutting rates, it’s not too early to start preparing for a September rate cut,” Stephen Gallagher, economist at Societe Generale, wrote in a client note.

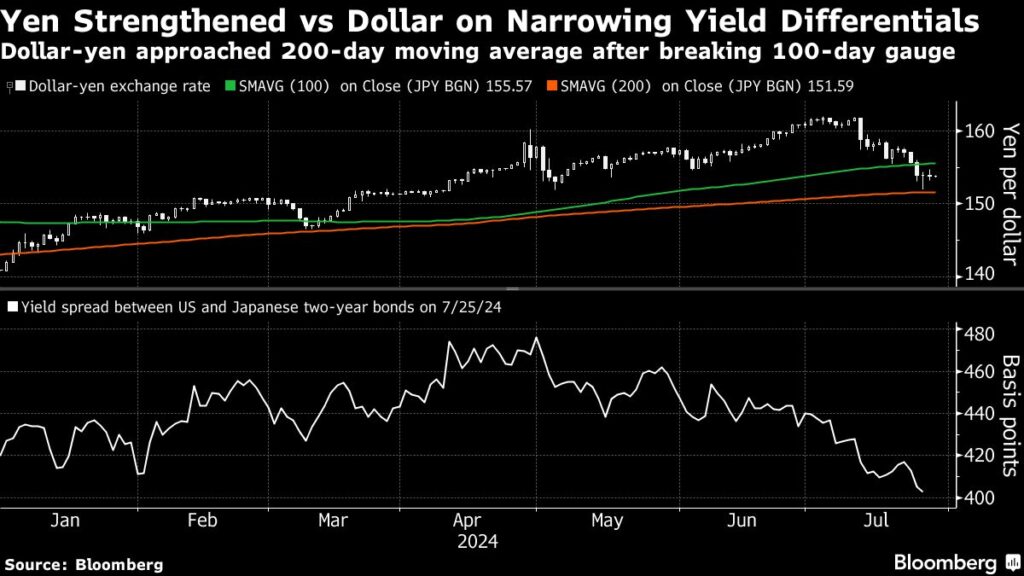

Hours before the Fed’s decision, the Bank of Japan is expected to announce details of its plan to reduce its monthly bond purchases at the end of its two-day policy meeting on Wednesday, but most economists also see the risk of a rate hike.The yen rose 2.4 percent against the dollar last week as traders put the chance of a 10 basis point hike at more than two-thirds, triggering a sell-off in risk-sensitive developed and emerging market currencies and leading to a technical correction in the Nikkei average.

The story continues

“Derivatives market prices are signaling that a failure by the BOJ to raise rates could be more destabilizing than the hike itself,” Mark Chandler, chief market strategist at Bannockburn Global Forex, wrote in a client note. “Failure to raise rates would likely spark more yen selling.”

Elsewhere in Asia, manufacturing activity data from China is due to be released this week, providing further insight into the People’s Bank of China’s surprise interest rate cut to jump-start its sluggish economy. Inflation data from Australia is also hotly anticipated, with investors and analysts debating whether the country’s central bank will raise interest rates as early as next week.

Oil prices rose ahead of a key OPEC+ meeting this week, but analysts are divided on whether the group will go ahead with plans to boost supply next quarter. The coalition is trying to bring back supplies it has withdrawn from the market for two years in a bid to boost prices, but slowing economic growth in major consumer China and new oil supplies from the Americas threaten to derail the plan.

There are also few signs of an easing of tensions in the Middle East, with Turkish President Recep Tayyip Erdogan hinting at the possibility of intervening on behalf of the Palestinians, possibly with military support. Israel attacked Hezbollah on Sunday and warned of further retaliation for rocket attacks, but also sounded open to a proposed Gaza ceasefire that could defuse a second, more violent conflict with Lebanon.

Some of the key market developments:

stock

S&P 500 futures were up 0.2% as of 9 a.m. Tokyo time

Hang Seng futures rose 0.6%

Japan’s TOPIX rises 1%

Australia’s S&P/ASX 200 rose 0.1%

Euro Stoxx 50 futures up 1.1%

currency

The Bloomberg Dollar Spot Index was little changed.

The euro was little changed at $1.0852

The Japanese yen weakened 0.2% to 154.12 to the dollar.

The offshore yuan was little changed at 7.2656 per dollar.

Cryptocurrency

Bitcoin rose 0.4% to $68,261.51.

Ether rose 0.3% to $3,270.63.

Bonds

merchandise

West Texas Intermediate crude rose 0.2% to $77.29 a barrel.

Spot gold rose 0.4% to $2,397.49 an ounce.

This story was produced with assistance from Bloomberg Automation.

–Matthew Burgess with assistance.

Most read articles on Bloomberg Businessweek

©2024 Bloomberg LP