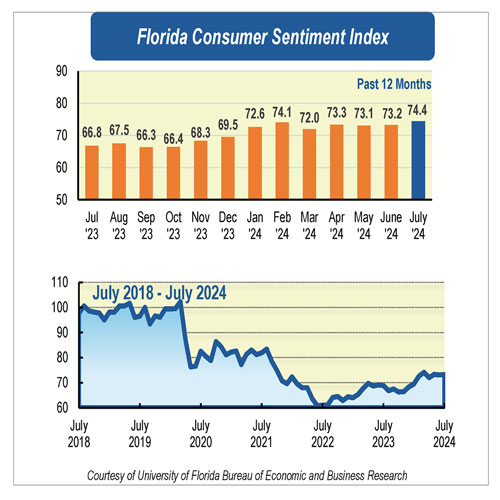

Consumer sentiment among Floridians increased for a second consecutive month in July, climbing 1.2 points to 74.4 from a revised 73.2 in June. In contrast, national consumer sentiment declined for the fourth consecutive month, dropping 1.8 points.

“Florida consumer sentiment appears to have improved in recent months. Notably, future economic expectations are at their highest level since the summer of 2021, reflecting Floridians’ brighter economic outlook. Additionally, as inflation recedes, the Fed will likely begin to cut interest rates later this year, which could further improve economic conditions,” said Hector Sandoval, director of the Economic Analysis Program at the University of Florida’s Bureau of Economic and Business Research.

All five components of the index rose in July.

Floridians’ opinions of their current economic situation improved in July. Opinion about their personal financial situation increased 1.8 points from 58.6 to 60.4 compared to a year ago, the largest increase of any survey result this month. Similarly, opinion about whether now is a good time to purchase major household items such as refrigerators or furniture increased just half a point from 62.1 to 62.6. These positive opinions were shared across socio-demographic groups, except for those making less than $50,000 a year, who reported less optimistic views on both items, and those 60 and older, who reported less favorable views on their personal financial situation.

Similarly, expectations for future economic conditions were also more positive. Expectations for personal finances one year from now increased 1.4 points, from 87.4 to 88.8. Notably, these positive expectations were shared by all Floridians except those earning less than $50,000 a year, who held less favorable views. Similarly, expectations for the state of the U.S. economy over the next year increased 1.6 points, from 75.2 to 76.8, and expectations for the next five years increased one point, from 82.6 to 83.6. However, views on the national economy were divided among socio-demographic groups. Women and those earning more than $50,000 a year reported less favorable expectations on both dimensions.

“Floridians’ growing optimism is consistent with the current economic outlook. Inflation appears to be trending downward, with recent data showing a decline in June. The Consumer Price Index (CPI) fell to 3%, while the Personal Consumption Expenditures (PCE) Price Index, the Fed’s preferred inflation measure, fell to 2.5%. Economic growth also accelerated in the second quarter, driven by increased consumer spending, with annual growth of 2.8%. Additionally, while there are signs that the labor market is gradually cooling, the unemployment rate remains historically low,” Sandoval said.

“Given the economic outlook going forward, we expect consumer sentiment to continue to improve gradually over the coming months,” Sandoval added.

The UF survey, conducted June 1 through July 25, reflects responses from 502 people, including 229 who responded by cell phone and 273 who responded through an online panel, making it representative of a demographic cross-section of Florida. The index used by the UF researchers was based on the year 1966, with a value of 100 representing the same confidence level for that year. The lowest index is 2 and the highest index is 150.

For more information on this month’s survey, visit https://www.bebr.ufl.edu/florida-consumer-sentiment/

/Public Release. This material from the originating organization/author may be out of date and has been edited for clarity, style and length. Mirage.News does not take any organizational stance or position and all views, positions and conclusions expressed here are solely those of the authors. Read the full article here.

Source link