(Bloomberg) — Stocks rose at the end of a turbulent week as key economic data bolstered expectations that the Federal Reserve will prepare to cut interest rates in September.

Most read articles on Bloomberg

All the major groups in the S&P 500 rose on Friday on bets that the Fed’s easing cycle will continue to fuel U.S. companies and that the bull market isn’t just limited to a few.Big technology companies have enjoyed big gains this year, but so-called concentration risk has come to the fore following a disappointing start to earnings season for large companies.

The flow of money into cyclical stocks has been spurred by data favorable to the Fed. After months of seeing few options beyond a narrow group of market winners, investors suddenly faced more choices. Financials, industrials and consumer staples mostly outperformed technology in July. Small caps rose 10% on the view that their higher debt loads would do better with lower interest rates.

“The strength of small caps is the biggest turnover we’ve seen in decades,” said George Mallis of Principal Asset Management. “With earnings likely to grow and recover, enthusiasm for small caps will grow. This turnover is likely to continue.”

Economic data on Friday backed up that view. The Fed’s preferred gauge of underlying U.S. inflation, the core personal consumption expenditures price index, rose at a moderate pace in June, suggesting that spending remained healthy. U.S. consumer sentiment fell to an eight-month low in July.

“The prospect of interest rate cuts is supporting a surge-like move into small and mid-cap stocks,” said Quincy Krosby of LPL Financial. “But there are growing concerns that a weakening U.S. economy could easily dampen investor interest, as small and mid-cap stocks require robust economic conditions.”

The S&P 500 rose 1.1%. The Dow Jones Industrial Average rose 1.6%. The Nasdaq 100 added 1%. The small-cap Russell 2000 rose 1.7%. Homebuilding stocks hit record highs. 3M Co, the iconic maker of Post-it notes, surged the most since 1980 on bullish prospects. The initial public offering of Bill Ackman’s U.S. closed-end fund was postponed.

The yield on the 10-year Treasury note fell 5 basis points to 4.19%.

The story continues

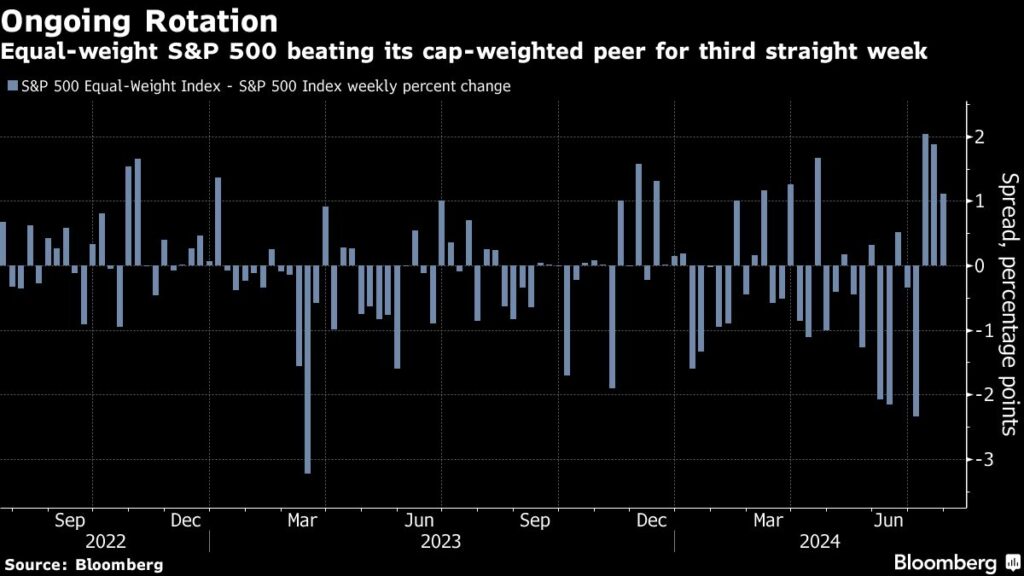

An equally weighted version of the S&P 500 – giving Target Corp. the same influence as Microsoft Corp. – outperformed the U.S. stock benchmark for the third straight week.

It’s a notable shift for a gauge that has lagged the S&P 500 for months, and it comes as optimism about an eventual monetary easing is swaying investors away from the perceived safety of Big Tech companies.

“We believe a meaningful rotation from large growth stocks to small and mid-cap value stocks is underway and will continue,” said Craig Johnson at Piper Sandler. “Our broad-based metrics support this dramatic shift, and we also see technical evidence that investors are reducing concentration risk in the ‘lagging’ seven and other large leaders.”

The Fed is likely to signal next week that it plans to cut interest rates in September, according to economists surveyed by Bloomberg News, a move that would begin a series of quarterly rate cuts through 2025. Nearly three-quarters of respondents said the U.S. central bank will use the meeting to set the stage for a quarter-point rate cut at its next meeting in September.

“It looks like the tide is finally turning,” TradeStation’s David Russell said in commentary on the latest inflation data. “Investors can now focus on big earnings releases next week and not worry too much about prices and interest rates.”

“Earnings reports from large tech companies next week will be an important test for a market trying to find direction amid mixed economic data underpinned by historically negative seasonal patterns,” LPL Financial’s Crosby said.

Indeed, traders will be keeping an eye on big earnings from big tech companies.

The stakes were already high for the group heading into earnings season, and they were further raised this week by disappointing results from two big companies that sent their stocks plummeting: Apple Inc., Microsoft Corp., Amazon.com Inc. and Meta Platforms Inc. are all due to report earnings next week.

“The ‘earnings issue’ will likely become more important as we move into August,” said Matt Murray of Miller, Tabak & Co. “If this earnings season continues to weigh on tech stocks, we’ll likely see investors start to ‘shift’ into cash rather than small caps.”

If the U.S. economy continues to cool, gains in the nation’s largest technology stocks could slow further, according to Bank of America’s Michael Hartnett.

The strategist, who is bullish on bonds for the second half of 2024, said signs of an economic slowdown would spur a return to stocks, which have lagged expensive tech giants this year.

Hartnett said recent data suggests the global economy is “in a slump” and that “a worse jobs report would cause big tech stocks to lose their advantage.”

Here’s some advice from Strategas: When it comes to markets and earnings, you should fear rate cuts, not rate pauses.

According to Strategas’ Jason de Sena Trenerth and Ryan Grabinski, markets tend to perform much better in the period between the Fed’s last rate hike and the first rate cut in a tightening cycle than they do after the first cut in the federal funds rate.

On average, the market bottoms 213 days after the first in a series of rate cuts, but stocks fall 23%. S&P 500 operating profits fall about 10% on average in the 12 months after the first rate cut, according to Strategas.

Company Highlights:

Honeywell International Inc. is considering an initial public offering as soon as next year for quantum computing company Quantinum Inc., in which it holds a majority stake, according to people familiar with the matter.

McDonald’s Corp.’s new $5 meal deal has slightly boosted traffic in its U.S. restaurants and lured back lower-income customers, the first sign that the burger chain’s more affordable strategy is working.

Apollo Global Management has agreed to acquire the gaming division of International Game Technology Corp. and gambling equipment company Everi Holdings Inc. for $6.3 billion in an all-cash transaction that will result in the two companies merging.

Apple lost ground in China’s smartphone market in the fourth quarter as local companies such as Huawei Technologies Co. surged.

Dexcom Inc., a maker of blood glucose monitoring devices for diabetics, surprised Wall Street with an unexpected and steep cut in its 2024 sales outlook, sending its shares plummeting.

Some of the key market developments:

stock

The S&P 500 was up 1.1% as of 4 p.m. New York time.

The Nasdaq 100 rose 1%

The Dow Jones Industrial Average rose 1.6%.

The MSCI World Index rose 0.9%.

The Bloomberg Magnificent 7 Total Return Index rose 0.9%.

The Russell 2000 Index rose 1.7%.

currency

The Bloomberg Dollar Spot Index was little changed.

The euro rose 0.1% to $1.0857.

The British pound rose 0.2% to $1.2873.

The Japanese yen rose 0.1% to 153.78 yen to the dollar.

Cryptocurrency

Bitcoin rose 4% to $67,913.38.

Ether rose 3.6% to $3,267.93.

Bonds

The yield on the 10-year Treasury note fell 5 basis points to 4.19%.

German 10-year government bond yields fell 1 basis point to 2.41%.

UK 10-year government bond yields fell 3 basis points to 4.10%.

merchandise

West Texas Intermediate crude fell 1.9% to $76.80 a barrel.

Spot gold rose 0.9% to $2,386.90 an ounce.

This story was produced with assistance from Bloomberg Automation.

–With assistance from Janet Freund, Jessica Menton, Sagarika Jaisinghani, Steve Matthews, Dana Morgan, Alex Nicholson, Chiranjivi Chakraborty, and Richard Henderson.

Most read articles on Bloomberg Businessweek

©2024 Bloomberg LP