(Bloomberg) — After a strong rally that drove the U.S. stock market to a record high, the start of the “Magnificent Seven” earnings season failed to impress investors.

Most read articles on Bloomberg

The $290 billion exchange-traded fund (ticker: QQQ) that tracks the Nasdaq 100 Index fell in late trading. Alphabet fell despite reporting better-than-expected earnings and its CEO suggesting investors should be patient until it sees tangible results from its investments in artificial intelligence. Tesla fell after profits fell short of expectations and the electric car giant postponed its robotaxi event until October.

The Magnificent Seven’s early earnings outlook is unimpressive

“Given the high earnings expectations of the Magnificent Seven, these companies will have a lot to prove,” said Anthony Sagrimbene at Ameriprise. “At the same time, their prospects will likely be heavily scrutinized relative to their inflated valuations.”

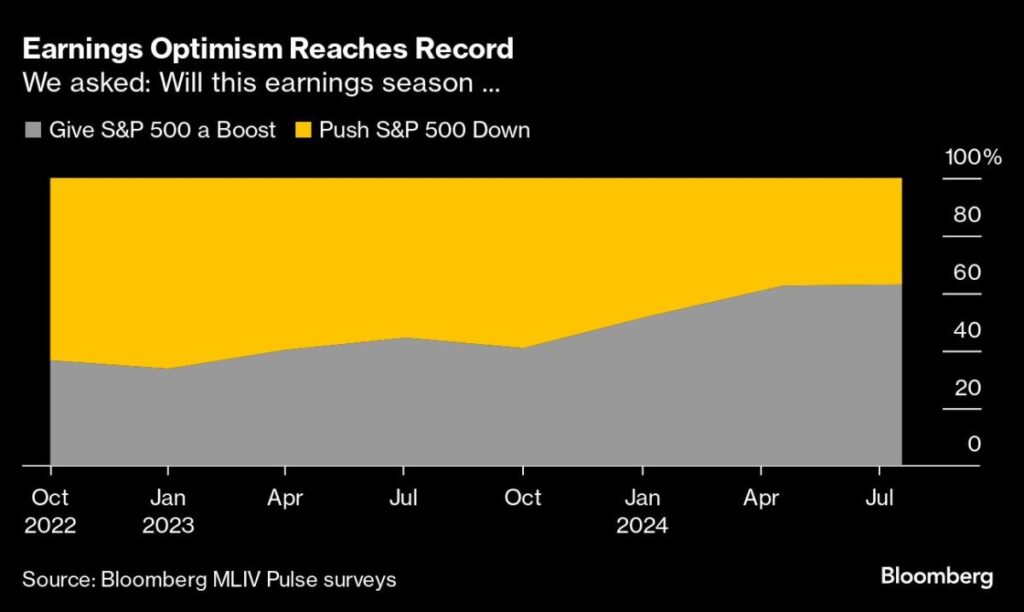

Strong earnings will provide a much-needed boost to stocks after strong performances in the first half of the year, as the market faces pressure amid a seasonally weak period and the US presidential elections are likely to add to volatility.

In regular trading, stocks struggled to rise amid a slew of earnings reports, with the S&P 500 closing slightly lower. The “Magnificent Seven” index underperformed the Russell 2000 index of smaller companies. United Parcel Service Inc. suffered its worst ever fall after reporting earnings that fell short of expectations.

U.S. two-year Treasury yields fell after a $69 billion auction confirmed market expectations of a rate cut. Crude oil tumbled on algorithmic selling and a summer liquidity slump.

Big technology companies, which have driven U.S. stocks higher for much of this year, hit a wall last week. Investors, spurred by hopes of Federal Reserve interest rate cuts, threats of more trade restrictions on chipmakers and worries that hype around artificial intelligence may be overblown, switched money from high-flying large stocks to riskier, weaker parts of the market.

The Big Five U.S. technology companies are facing a tougher earnings cycle than last year’s stellar earnings cycle, with the group’s profits expected to rise 29% in the second quarter from a year earlier, according to data compiled by Bloomberg Intelligence.

The story continues

While still strong, that’s down from the past three quarters, and how stocks will react to earnings remains one of the biggest uncertainties for investors.

“The fact that these stocks were in a weak spot ahead of their earnings releases isn’t necessarily a bad thing, as it just means the hurdle for stocks to rise in the run-up to the earnings release may be unrealistically high,” Bespoke Investment Group said. “It doesn’t take a gymnast to know that the lower the hurdle, the easier it is to overcome it.”

“We expect earnings season to boost confidence in equity markets,” said Solita Marcelli of UBS Global Wealth Management. “While markets may be volatile in the short term after a period of overextended investor positions, we believe fundamentals remain solid.”

Investors are worried about a continued sell-off in big U.S. tech shares, but Barclays strategists say strong earnings prospects mean the stocks remain attractive after the recent sell-off.

Venu Krishna’s team raised its year-end target for the S&P 500 index to 5,600 points from 5,300 points, citing strong earnings prospects for big technology companies.

“While our valuation assumptions for large technology companies are high, growth-adjusted multiples are reasonable and we expect the group to deliver earnings commensurate with its valuation,” they said.

Bank of America clients sold off a large amount of U.S. stocks after the S&P 500 index posted its worst week since April, with outflows coming from institutions and hedge funds leading the way while retail investors were smaller net buyers.

Quantitative strategists led by Jill Carey Hall said Tuesday that Bank of America clients sold $7 billion off U.S. stocks last week, the biggest selloff since November 2020. Technology stocks saw their first outflows since May.

Company Highlights:

Visa Inc. reported quarterly earnings that fell short of Wall Street expectations, a rare development for the world’s largest payments network.

Texas Instruments Inc. gave current-quarter guidance in line with expectations.

Soft drinks giant Coca-Cola raised its full-year outlook as higher prices helped improve business performance.

Kimberly-Clark Corp., which owns the Kleenex brand, said its quarterly sales fell short of expectations.

Philip Morris International raised its full-year profit growth forecast due to increased demand for Zyn nicotine pouches.

Comcast Corp. said its second-quarter profit fell short of analyst expectations, due to weakness at its movie studios and theme parks.

General Motors Co.’s profits rose 60 percent from a year ago, far beating Wall Street expectations as demand for gasoline-powered trucks in the United States strengthened.

Southwest Airlines has been facing increased scrutiny from U.S. regulators over a series of recent flight-safety accidents involving the airline.

LVMH’s sales growth slowed last quarter as the wealthy curbed spending on pricey Louis Vuitton handbags and Christian Dior couture.

Major events this week:

Canada interest rate decision Wednesday

U.S. New Home Sales, S&P Global PMI, Wednesday

IBM, Deutsche Bank Earnings Wednesday

German IFO Business Environment, Thursday

US GDP, initial jobless claims, durable goods, Thursday

US Personal Income, PCE, Consumer Sentiment Friday

Some of the key market developments:

stock

The S&P 500 was down 0.2% as of 4 p.m. New York time.

The Nasdaq 100 fell 0.3%.

The Dow Jones Industrial Average fell 0.1%.

The MSCI World Index was little changed

Bloomberg Magnificent 7 Total Return Index little changed

The Russell 2000 Index rose 1%.

currency

The Bloomberg Dollar Spot Index rose 0.2%.

The euro fell 0.4% to $1.0850.

The British pound fell 0.2% to $1.2903.

The Japanese yen rose 0.9% to 155.64 yen to the dollar.

Cryptocurrency

Bitcoin fell 3.9% to $65,509.96.

Ether fell 0.9% to $3,459.34.

Bonds

The yield on the 10-year Treasury note was little changed at 4.25%.

German 10-year government bond yields fell 6 basis points to 2.44%.

UK 10-year government bond yields fell 4 basis points to 4.12%.

merchandise

West Texas Intermediate crude fell 1.3% to $77.36 a barrel.

Spot gold rose 0.5% to $2,407.85 an ounce.

This story was produced with assistance from Bloomberg Automation.

–With assistance from Sagarika Jaisinghani, Jessica Menton, and Tatiana Darie.

Most read articles on Bloomberg Businessweek

©2024 Bloomberg LP