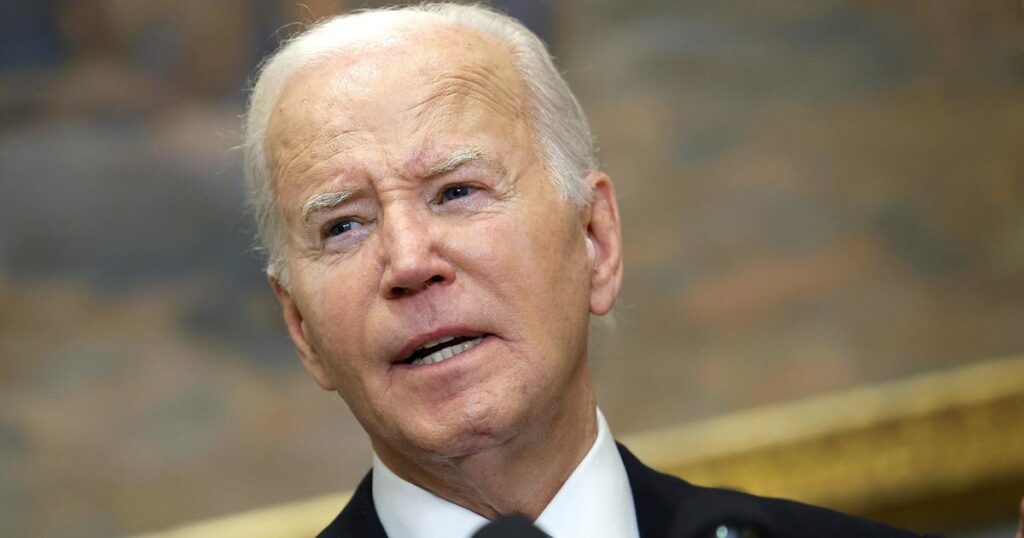

President Biden’s move to drop out of the presidential race and endorse Vice President Kamala Harris for the Democratic nomination has prompted investors and economists to reassess the race’s impact on everything from the stock market to the so-called “Trump trade.”

For now, U.S. markets have taken Biden’s announcement that he is quitting the election in stride, with the broad S&P 500 index and the tech-heavy Nasdaq both rising in Monday trading, in part because Wall Street had already priced in the possibility of Biden stepping down. But in the short term, investors are warning that U.S. markets could see more volatility, especially if a new Democratic candidate emerges and the race intensifies.

Before Biden’s decision on Sunday, former President Trump was leading in the polls and had his largest national lead of the election to date. That boosted the Trump trade, a strategy in which investors bet on assets and stocks, from cryptocurrencies to energy stocks, that they believe will benefit under a Republican administration.

Click here to see related media.

Click to enlarge

But now Wall Street is assessing the new landscape and scrutinizing Harris’ economic policies and views. Harris has garnered support from leading Democratic candidates and replaced Biden as the top presidential candidate. The emergence of a new Democratic presidential candidate could ultimately lead to a tighter race than was expected before Biden’s decision, potentially sparking further volatility in U.S. markets as investors try to gauge which party and its economic policies will win in November, investors said.

“U.S. politics will be much more unpredictable than investors had expected for at least the next three months, and this increased uncertainty will inevitably be bearish for most assets that are valued on the premise of predictability and priced on the premise of perfection in a world where you should expect the unexpected,” Anatole Kaletsky, co-founder and chief economist at investment advisory firm Gavekal, said in a research note.

Impact on the stock market

In other words, some investors are warning that the S&P 500, which has surged 22% over the past 12 months, could face downward pressure due to the renewed unpredictability of the presidential election.

“Biden’s departure is a new level of political uncertainty, which could trigger some overdue market volatility,” Gina Bolvin, president of Bolvin Wealth Management Group, said in an email.

Still, Wall Street’s shrug on Monday morning underscored how investors typically rely on key economic data like inflation reports and corporate earnings, rather than political races, to decide when and where to put their money.By many measures, the U.S. economy is expected to remain strong in 2024, with Goldman Sachs on Sunday predicting GDP growth of 2.5% in the second half of 2024, which would mean U.S. growth will be on par with 2023.

The Fed is widely expected to start cutting interest rates when it meets in September, a move that could ease borrowing costs for homebuyers and businesses and spur investment and spending.

“[I]”Investors should remember that U.S. political outcomes are far from the biggest driver of financial market returns, or even sector performance,” Solita Marcelli, chief investment officer for the Americas at UBS Global Wealth Management, said in an email. “Economic data and expectations of Federal Reserve rate cuts are at least as important.”

Trump Trade

Indeed, many institutional investors still see Trump as favored regardless of whether he faces Harris or another Democratic candidate. Trump’s election odds have dropped slightly and Harris’ odds have risen by 11 percentage points, according to prediction market PolyMarket, but they still lag behind Trump.

The new odds have some investors shifting their attention away from the Trump trade, which appears to be fading following Biden’s decision. For example, Trump is seen as crypto-friendly, and Bitcoin has surged more than 50% so far this year. But on Monday, Bitcoin prices fell 1.5%, dragging other cryptocurrencies down as well.

Examining the causes of American voter anger over the economy

“We’ve seen a reversal in the ‘red’ sector and a reversal out of the ‘blue’ sector over the past few weeks as the market continues to favor Republicans,” UBS’s Marcelli said. “We could see at least a partial reversal in the coming days as the market analyzes the latest developments.”

What are Harris’ economic views?

Wall Street is also closely watching Harris’ economic views to gauge how her candidacy and election to the White House would affect the economy and U.S. markets. Economists say she is likely to continue Biden’s policies, which focused on tackling climate change and scrutinizing anti-competitive behavior by big corporations.

Marcelli said a Democratic administration would be “likely to continue supporting initiatives that benefit green energy, efficiency and electric vehicle manufacturers.”

One of the biggest areas where Biden and Harris disagree is trade policy, BTIG’s Isaac Boltanski wrote in a research report on Monday.

“Indeed, after researching policy proposals and numerous contact conversations, I found that the only area where things differed even slightly was trade policy,” Boltanski wrote.

For example, as a senator, Harris voted against the United States-Mexico-Canada Agreement (USMCA), a 2020 trade pact signed into law by former President Donald Trump that replaced the North American Free Trade Agreement (NAFTA), and she opposed it for climate reasons. Harris also opposed the 2016 trade pact, the Trans-Pacific Partnership (TPP), for similar reasons.

This could suggest that Harris might prioritize environmental and climate issues over trade deals, for example, but “there are little to no policy differences between Biden and Harris, and that’s what matters most,” Boltanski said.

More from CBS News

Amy Picchi